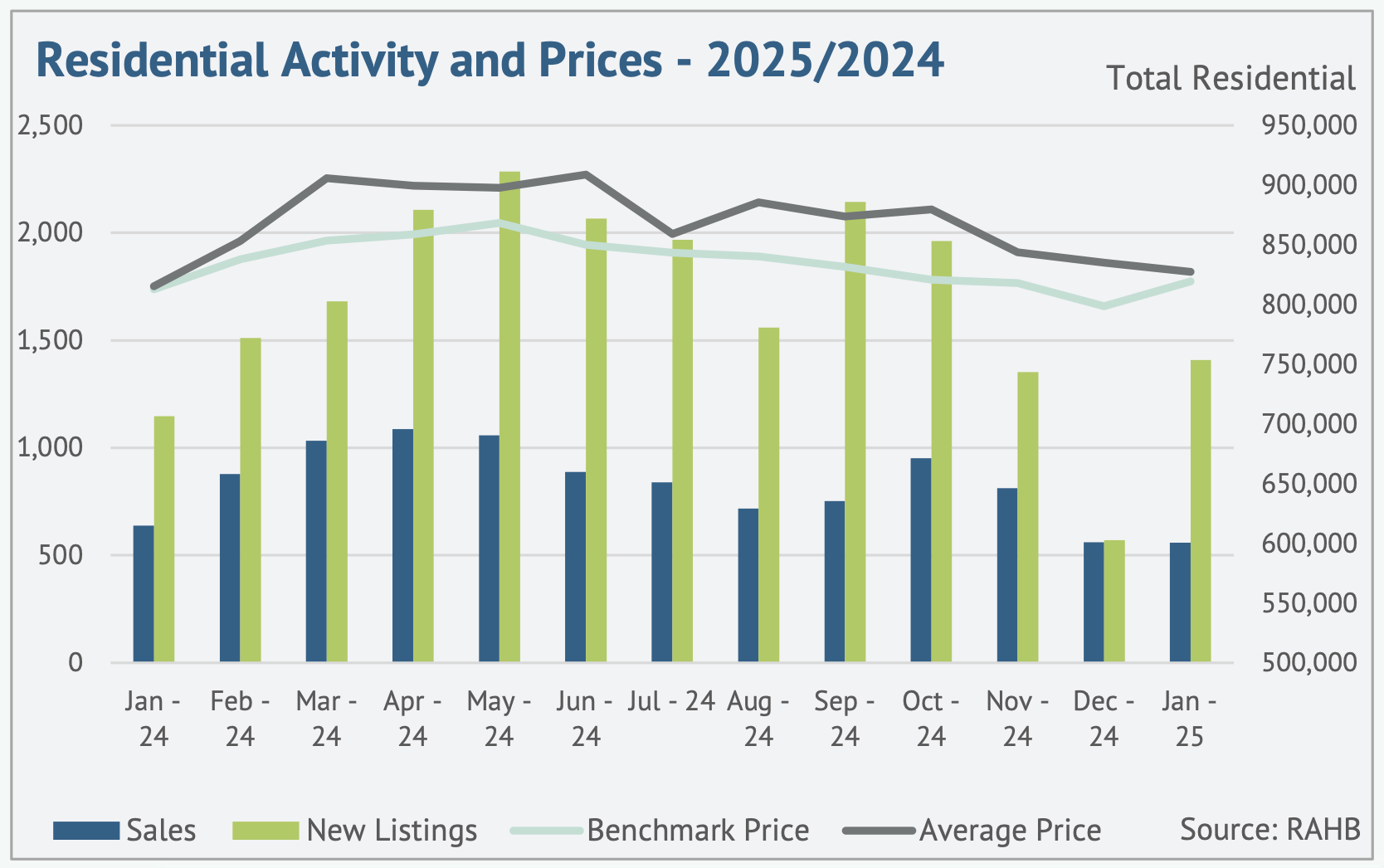

Curious about the latest real estate trends and what they mean for you? The stats are in, and there’s a lot to unpack! Let’s dive into this graph for a closer look at residential activity and pricing trends over the past year.

The gap between new listings and sales may suggest that buyers are becoming more selective, taking their time to find the right home, possibly due to affordability concerns or market uncertainty. In December, the alignment between sales and listings indicates a seasonal slowdown, typical for the holidays when fewer buyers and sellers are active.

Now, what does it mean when average prices rise above benchmark prices? Before we jump into that, let’s first define each term.

The benchmark price refers to the estimated value of a "typical" home in a given area based on the most common attributes of properties sold.

The average price is the total dollar value of all sales divided by the number of sales.

When average prices trend higher than benchmark prices, it usually indicates that higher-end homes are selling more frequently or that there has been a shift in the types of properties being sold. Here are a few examples of what it can mean:

More Luxury or High-End Sales: If a higher number of expensive homes sell in a given period, the average price will increase, even if typical home values (benchmark price) remain stable. This happens in markets where luxury buyers are active, while entry-level buyers may be priced out.

Fewer Entry-Level Home Sales: If fewer lower-priced homes are selling (e.g., due to affordability challenges or lack of supply), the average price rises, even though the typical home price (benchmark) hasn’t changed much.

Market Distortion from Unique Sales: The average price can be skewed by a small number of unusually high-priced sales, but the benchmark price remains steady because it reflects a "typical" home rather than extremes.

Possible Market Shift Toward Larger or Higher-End Homes: If buyers are purchasing bigger or more expensive homes (e.g., post-pandemic demand for space), the average price rises. Benchmark prices rise more gradually since they track a "typical" home.

Why Does This Matter?

If average prices are rising faster than benchmark prices, it may not mean all homes are getting more expensive—just that higher-end properties are selling more.

Interested in learning more about the market trends in your area or how this impacts your buying or selling decisions? Contact me today, and let's chat about your next steps!

Home Prices & Sales in 2024 - What the Numbers Reveal